CONSUMER PRICE INDEX, JANUARY 2024

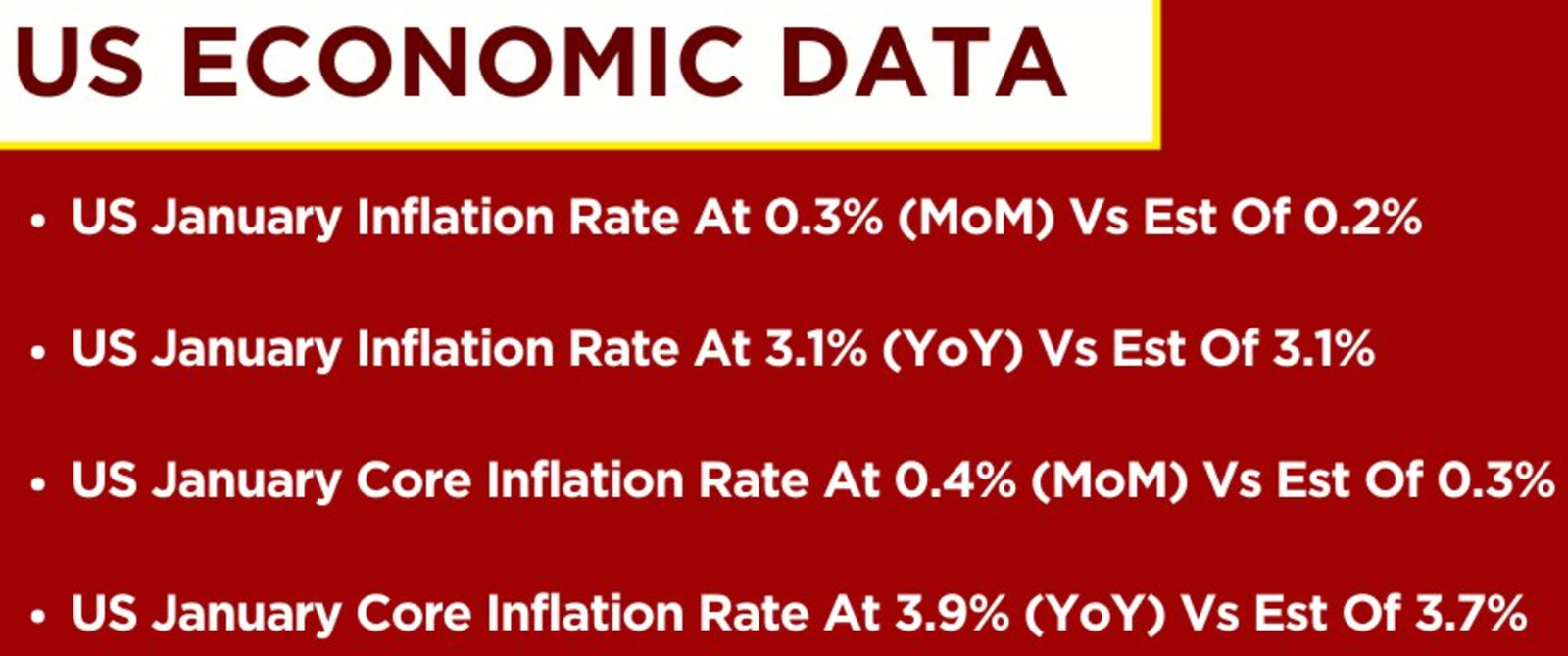

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% in January on a seasonally adjusted basis after rising 0.2% in December, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased by 3.1% before seasonal adjustment.

The index for shelter continued to rise in January, increasing by 0.6% and contributing over two-thirds of the monthly increase in all items. The food index increased 0.4% in January, as the food at home index increased 0.4% and the food away from home index rose 0.5% over the month.

In contrast, the energy index fell 0.9% over the month due in large part to the decline in the gasoline index.

The index for all items less food and energy rose 0.4% in January. Indexes that increased in January include shelter, motor vehicle insurance, and medical care. The index for used cars and trucks and the index for apparel were among those that decreased over the month.

The all-items index rose 3.1% for the 12 months ending January, a smaller increase than the 3.4% increase for the 12 months ending December. All items less food and energy index rose 3.9% over the last 12 months, the same increase as for the 12 months ending December.

The energy index decreased by 4.6% for the 12 months ending January, while the food index increased by 2.6% over the last year.

Volatility and repricing trades are poised to make a resurgence as US inflation data surprises the markets, with consumer prices rising by 3.1% in January, surpassing market expectations.

According to government data, US consumer inflation slowed less than anticipated last month. The Consumer Price Index, a closely monitored indicator, increased by 3.1% from a year ago in January, down slightly from 3.4% in December.

Read More on US Inflation

Madhavi Arora, a lead economist at Emkay Global, commented, “Even though headline inflation exceeded 3%, core inflation for January 2024 came in much higher than expected. This demonstrates that the path to disinflation remains challenging, leading to a delay in market expectations for rate cuts, possibly beyond May and even June.”

The release of the inflation data led to a drop in US stocks and an increase in Treasury yields as investors adjusted their expectations regarding Federal Reserve interest rate cuts. The S&P 500 index fell by 1.4%, while the Nasdaq Composite dropped by 1.8%.

Following the data release, the probability of a rate cut in May, as implied by futures markets, decreased from 50% to 30%. The possibility of a rate cut in March was nearly eliminated.

Dean Maki, chief economist at Point72 Asset Management, remarked, “This data complicates the Fed’s plan for relatively early rate cuts. A rate cut in March is off the table, and a cut in May seems unlikely.”

Economists surveyed by Bloomberg had anticipated annual consumer price inflation to be 2.9%, down from 3.4% in December.

Core inflation, which excludes volatile food and energy prices, remained strong at 3.9% year over year in January.

The Federal Reserve’s preferred measure of inflation, the core personal consumption expenditures index, showed a less significant increase than the CPI. The core PCE index rose by 2.9% in January on an annual basis, marking the first reading below 3% in approximately three years.

US President Joe Biden acknowledged the decline in inflation but emphasized the need for further efforts to reduce costs, especially amid strong growth and employment.

The Fed’s next policy meeting, scheduled for March 19-20, will provide updated projections for interest rates, inflation, and unemployment.

[…] US Inflation […]

[…] Also Read: US Inflation […]